Secure Your Structure: Trust Foundations for Longevity

Secure Your Structure: Trust Foundations for Longevity

Blog Article

Protecting Your Properties: Count On Structure Know-how at Your Fingertips

In today's intricate monetary landscape, making certain the security and growth of your assets is vital. Trust fund structures offer as a keystone for guarding your wide range and heritage, giving an organized strategy to property defense.

Value of Depend On Structures

Depend on foundations play a vital function in establishing reliability and fostering strong relationships in numerous specialist setups. Building trust is essential for businesses to grow, as it creates the basis of successful partnerships and partnerships. When trust fund is existing, individuals feel extra positive in their interactions, leading to raised efficiency and effectiveness. Trust structures work as the cornerstone for moral decision-making and transparent communication within companies. By prioritizing trust fund, services can create a favorable work society where workers feel valued and valued.

Benefits of Expert Assistance

Building on the structure of count on specialist partnerships, looking for professional support uses indispensable benefits for individuals and organizations alike. Specialist advice gives a riches of knowledge and experience that can help browse complex economic, legal, or strategic obstacles easily. By leveraging the proficiency of specialists in different fields, individuals and organizations can make informed choices that straighten with their goals and ambitions.

One significant advantage of expert guidance is the capacity to gain access to specialized understanding that might not be easily available or else. Professionals can offer understandings and point of views that can lead to ingenious services and possibilities for growth. Additionally, collaborating with experts can aid reduce threats and uncertainties by providing a clear roadmap for success.

Moreover, expert advice can save time and sources by streamlining procedures and avoiding expensive mistakes. trust foundations. Experts can supply individualized advice tailored to details needs, making certain that every decision is knowledgeable and critical. In general, the advantages of expert assistance are complex, making it a valuable possession in guarding and taking full advantage of properties for the long term

Ensuring Financial Safety

In the world of financial planning, securing a stable and thriving future hinges on calculated decision-making and sensible financial investment options. Making certain economic protection entails a complex approach that encompasses various facets of wide range monitoring. One critical component is developing a varied financial investment profile tailored to private risk tolerance and financial objectives. By spreading out financial investments across different possession classes, such as stocks, bonds, realty, and assets, the threat of considerable monetary loss can be reduced.

In addition, preserving a reserve is essential to guard against unexpected costs or income disturbances. Professionals recommend reserving 3 to six months' well worth of living expenses in a fluid, easily obtainable account. This fund serves as a financial safeguard, supplying satisfaction throughout turbulent times.

Consistently evaluating and readjusting monetary strategies in reaction to transforming circumstances is likewise paramount. Life events, market variations, and legislative modifications can impact monetary security, underscoring the value of recurring assessment and adjustment in the search of long-term monetary protection - trust foundations. By executing these methods attentively and regularly, individuals can strengthen their economic footing and work in the direction of an extra secure future

Protecting Your Possessions Properly

With a solid foundation explanation in location for monetary protection through diversification and reserve upkeep, the following critical step is protecting your possessions properly. Guarding assets involves safeguarding your riches from prospective dangers such as market volatility, financial slumps, legal actions, and unpredicted expenditures. One reliable strategy is asset allocation, which involves spreading your investments throughout numerous property courses to lower threat. Expanding your profile can assist minimize losses in one location by stabilizing it with gains in an additional.

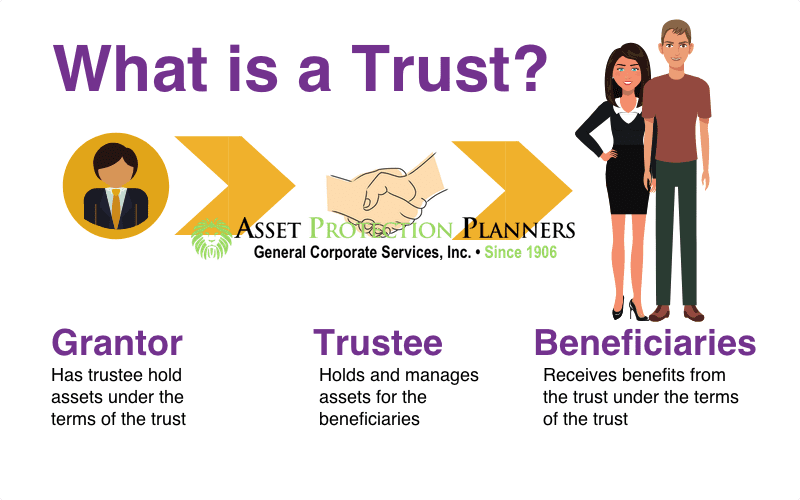

Additionally, developing a count on can supply a protected means to protect your properties for future generations. Trusts can assist you regulate exactly how your properties are distributed, lessen estate taxes, and safeguard your wide range from creditors. By carrying out these approaches and seeking expert advice, you can protect your properties effectively and secure your monetary future.

Long-Term Property Protection

Long-term asset protection entails applying procedures to secure your possessions from various threats such as financial slumps, suits, or unexpected life events. One critical facet of long-lasting asset defense is developing a count on, which can offer substantial browse around these guys benefits in shielding your properties from lenders and legal disagreements.

Additionally, diversifying your financial investment profile is another vital strategy for lasting possession protection. By spreading your financial investments across various possession courses, markets, and geographical regions, you can minimize the impact of market variations on your general wide range. Furthermore, regularly assessing and updating your estate strategy is necessary to make certain that your possessions are shielded according to your desires in the lengthy run. By taking a proactive strategy to long-term property protection, you can secure your wide range and offer economic safety and security for on your own and future generations.

Final Thought

In conclusion, count this page on structures play a crucial role in protecting properties and making certain financial safety and security. Professional support in developing and managing trust structures is vital for long-lasting property defense. By making use of the proficiency of professionals in this field, individuals can effectively guard their properties and prepare for the future with self-confidence. Trust fund structures give a strong structure for shielding wide range and passing it on future generations.

Report this page